Introduction

Stocks are one of the most commonly employed ways of building wealth and investing in the financial markets. Whether you’re a beginner or someone who wishes to know how companies fund themselves, stocks are an essential knowledge for anyone looking to learn about personal finance and investing. The article explains what stocks are, how they work, and why they matter.

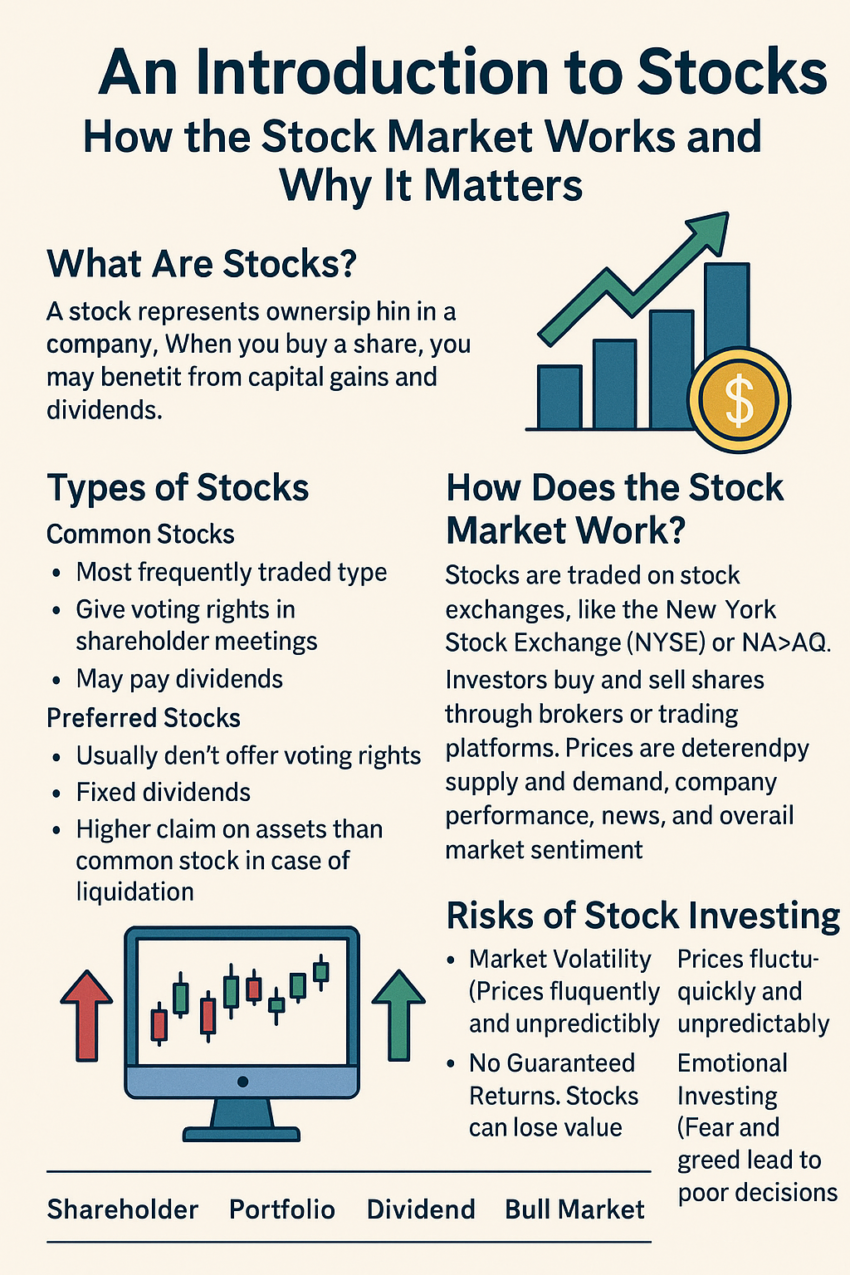

What Are Stocks?

A stock represents ownership of a firm. Purchasing a stock involves buying a fraction of the firm, commonly known as a share. As a shareholder, you can benefit from the company’s growth and profitability in the form of capital gains and dividends.

Why Do Companies Issue Stocks?

Companies issue stocks in order to obtain funds to further their business. This is an Initial Public Offering (IPO). By going public, companies can fund new projects, expand operations, pay off debt, or fund research.

Types of Stocks

Common Stocks

Most widely traded type

Grants voting rights at shareholder meetings

May pay dividends

Preferred Stocks

Usually no voting rights

Fixed dividends

Higher claim on assets than common stock when company liquidates

How Does the Stock Market Work?

Stocks are traded on stock markets, such as the New York Stock Exchange (NYSE) or NASDAQ. Investors trade or sell shares with the assistance of brokers or trading websites. Price is determined by the demand and supply, performance of the company, news, and mood in the market.

Advantages of Stock Investment

Ownership in Companies: Possess part of companies you trust.

Long-term Growth: Stocks have historically given high returns over the long term.

Liquidity: The shares are readily buyable and sellable on public stock markets.

Dividends: Some companies pay a portion of the profits to shareholders.

Risks of Stock Investing

Market Volatility: The prices may fluctuate quickly and unpredictably.

No Guaranteed Returns: The shares may lose value.

Emotional Investing: Greed and fear can lead to poor decisions.

Company Risk: The company may perform poorly or go bankrupt.

Basic Stock Market Terms

Shareholder: Single or multiple shares owner of a company.

Portfolio: A collection of investments that belong to an individual or institution.

Dividend: A distribution of company earnings to shareholders.

Bull Market: A period when stock prices are rising.

Bear Market: A period when stock prices are falling.

Conclusion

Stocks are a wonderful investment tool that can help someone increase their wealth in the long run. Understanding how the stock market works, what kinds of stocks exist, and the risks and advantages associated with it is necessary to be a savvy investor. Stock investment can be profitable and educational if done with research, patience, and a long-term point of view